Finding the Right Budgeting App for You

Your financial journey is unique, so you probably know the pain of randomly picking a budgeting app on the Play Store, only to abandon it because it didn’t fit your needs. There’s a whole sea of budgeting apps. It’s easier to drown in decision paralysis than find which one’s right for you.

Choosing the right app isn’t just about tracking expenses - it’s about finding something that aligns with your lifestyle. Are you more focused on achieving specific financial goals? Do you want to save more, or spend less? Are you a beginner in the dance that is financial management, and are looking for a partner to guide you?

These are just some of the decisions that go into picking the right app. For more detailed guidance, check our posts on how to pick a budgeting app and features to look for in a budgeting app . This post is a condensed version of those two.

How to Pick the Right Budgeting App

Choosing the right budgeting app can feel overwhelming with so many options available, but it doesn’t have to be. The key is to focus on what matters most to you - your financial goals, tech preferences, and lifestyle. The following section walks you through the essential considerations to find an app that fits seamlessly into your life, whether you’re a tech-savvy power user or someone who just wants a simple tool to stay on track.

Step 1: Define Your Financial Goals

The first step to finding the right budgeting app is understanding why you need one. Your primary financial goal will shape the features you prioritize, so take a moment to reflect on what you’re aiming to achieve.

The most common motivations and what to look for in an app are:

- Saving for a specific goal: If you’re working toward a big purchase—like a car, a vacation, or a down payment on a house, you’ll want an app that helps you set savings targets and track your progress. Look for tools that let you create dedicated savings buckets, visualize milestones, and send reminders to keep you motivated.

- Tracking day-to-day Spending: For those who want a clearer picture of where their money goes, an app with strong expense categorization and spending summaries is ideal. These tools break down your transactions into digestible insights, helping you spot patterns and adjust habits without too much effort.

- Paying off debt and improving financial health: If debt repayment or overall financial improvement is your focus, prioritize apps with debt management features. These might include payoff calculators, interest tracking, or insights into your financial habits to help you build a stronger foundation over time.

By starting with your “why,” you’ll narrow down the field to apps that align with your specific needs.

Step 2: Assess Your Comfort with Technology

Not all budgeting apps are created equally. Some are created to target power users - those that want to know every detail about their finances, while others are simply meant for keeping track of monthly fluctuations of expenses. Your comfort level with technology plays a big role in your decision.

Here’s how to match your tech-savviness to the right tool:

- Tech enthusiasts: If you’re very comfortable with technology, say goodbye to pen and paper. There are powerful, feature-rich apps that go beyond basic budgeting. They offer personalized insights, advanced analytics, and integrations with other financial platforms.

- Moderately tech-savvy: If you’re somewhat comfortable but not a pro, opt for an app that balances functionality with simplicity. Look for user-friendly interfaces that don’t overwhelm you but still provide enough features to keep your budget on track.

- Tech newbies: Not very tech-savvy? No problem. There are plenty of straightforward apps that focus on ease of use, with minimal setup and intuitive designs. These tools prioritize simplicity so you can focus on budgeting, not troubleshooting.

Picking an app that matches your tech comfort level ensures you’ll actually use it instead of letting it gather digital dust.

Step 3: Consider Your Go-To Device

Budgeting apps are often tailored to specific devices, so think about where you’ll do most of your financial planning. Your primary device can steer you toward the best fit:

- Smartphone users: If you’re always on your phone, choose an app optimized for mobile use. These apps shine with on-the-go updates, push notifications, and quick transaction logging—perfect for managing your budget in real time, wherever you are.

- Laptop or desktop fans: Prefer a bigger screen? Web-based platforms or desktop apps might suit you better, especially for in-depth financial management. They often provide detailed dashboards and reporting tools that are easier to navigate on a computer.

- Tablet lovers: If a tablet is your device of choice, look for apps that leverage the larger screen size. These offer a blend of mobile convenience and desktop-like visibility, making navigation and data entry a breeze.

Matching the app to your device ensures a smooth, frustration-free experience.

Step 4: Decide Whether You’re Willing to Spend

Budgeting apps come in free and paid flavors, and your willingness to spend can unlock additional features. Here’s how to weigh your options:

- Willing to pay for premium features: If you’re open to investing in your financial tools, paid apps often deliver extra value—think detailed analytics, personalized advice, or seamless syncing across multiple devices. These perks can be worth it if you’re serious about leveling up your money management.

- Prefer free, but open to upgrades: Prefer free options but don’t mind paying for more? Look for apps with a solid free version that covers the basics, plus affordable paid tiers for advanced tools. This gives you flexibility to test the waters before committing.

- Free only, no exceptions: If you need a no-cost solution, don’t worry, there are excellent free apps that still pack a punch. They may lack flashy extras, but they’ll get the job done with core budgeting features.

Your budget for an app is just as important as the budget it helps you manage, so choose wisely.

Step 5: Determine Your Need for Personalized Advice

Finally, think about how much guidance you want from your app. Some people love tailored insights, while others prefer a no-frills approach. Here’s how to decide:

- Craving tailored advice: If you want an app that analyzes your spending and offers custom recommendations—like suggesting areas to cut back or flagging overspending—go for one with robust personalization features. These apps act like a virtual financial coach.

- Advice is a bonus, Not a must: If personalized insights sound nice but aren’t essential, a mid-range app with basic analytics might be perfect. You’ll get some helpful nudges without the complexity of a full-on advisory tool.

- Simplicity is key: Prefer to keep things basic? Choose an app that sticks to straightforward budgeting—tracking income and expenses without extra commentary. Less is more if you just want the essentials.

Your preference for advice will fine-tune your choice, ensuring the app feels supportive rather than intrusive. Putting It All Together: Finding Your Perfect App

Now that you’ve walked through these steps, you should have a clear picture of what you need. Here’s a quick guide to match your preferences to the right type of app:

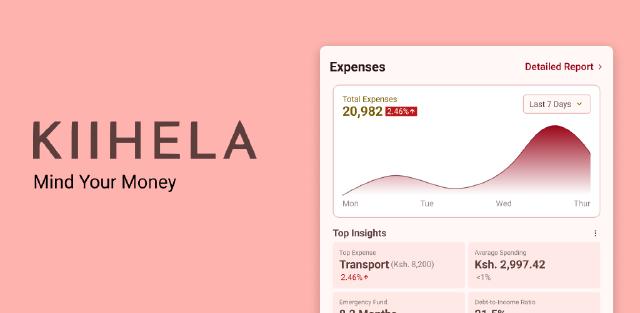

- If you’re a goal-driven tech lover willing to pay: You’re a candidate for a comprehensive app with advanced features and personalized insights. Tools like Kiihela offer robust budgeting capabilities, detailed tracking, and premium options to keep you in control.

- If you want simplicity and flexibility: A user-friendly app with an intuitive interface and optional upgrades is your sweet spot. Check out options like MySafaricom or Money Lover, which balance ease of use with helpful features.

- If you need free and easy: You’re after a no-fee, straightforward tool that covers the basics. Free apps like PesaManager or Monefy deliver essential budgeting without the clutter—or the cost.

The Best Budgeting Apps in Kenya

Different products cater to different markets and general-purpose solutions often don’t translate well to market-specific needs. While the features to look for in a budgeting app are more or less the same, the Kenyan market is unique in various ways—including its reliance on M-PESA.

All the same, general-purpose apps are often robust enough to handle a wide range of scenarios, and for that reason, some of them are featured here as well.

1. Kiihela

2. Goodbudget

3. You Need a Budget (YNAB)

4. Countpesa

5. Lunch Money

- Desktop-first

- Budgets

- Recurring expenses

- Collaboration

- Rules enginehttps://lunchmoney.app/features

Budgeting App Questionnaire

To help you navigate this complex landscape, we’ve designed a series of focused questions, and tested a number of apps to help you find the right budgeting app for your needs.

Questionnaire to Help You Find the Right Budgeting App

To help you navigate this complex landscape, we've designed a series of focused questions, and tested a number of apps to help you find the right budgeting app for your needs.

Please answer the questions below to get a personalized recommendation.

Recommendations: