Introduction

Saving money is the backbone of creating strong financial muscle. It’s never been easier to save money in Kenya than it is today, thanks to the plethora of investment and savings platforms on the market.

A good savings app should be focused on one thing - helping you set aside money that accumulates interest over time. While you could opt to go the traditional route and ave money in a bank, the right savings app could help you cut back on expenses, earn higher interest than average banks and automate your savings.

In this guide, we’ll explore the five best money-saving apps in Kenya, why they’re better than traditional savings options, their benefits, and how they can help you achieve your financial goals faster.

Why use a money-saving app?

Saving money is often dismissed by critics who argue “you can’t get rich by saving money.” While there’s truth to that, they’re missing the forest for the trees. Saving money aside isn’t about accumulating enough to jet off to the Caribbean whenever you feel like. It’s about creating a foundation, so you can do that in the future, if you want to.

Using a money-saving app is like having a copilot, or a coach. Sure, you could do it all on your own, but why struggle to do it on your own when there’s a more reliable way?

- Building a safety net smarter - life is very unpredictable. You never know when tragedy will strike, and there’s nothing worse than being caught flat-footed when the inevitable chaos comes. Sudden medical emergencies, a broken-down car… Savings help you calm the uncertain tide of life by giving you a barge to cling onto.

- Create investment opportunities - once the pile of money is big enough, you can finally put it to work. The money you’ve been accumulating can be put to work in investments like stocks, bonds, real-estate or even a side hustle. The earlier you start, the more time your money has to work for you.

- Dodge debt with discipline - living paycheck to paycheck often leads one to lean on payday lenders and expensive loans. These platforms are known to be very exorbitant, with interest rates that go up to 400% per year. Never mind the incessant calls, the unmasked threats and shame of having your relatives calling you out of the blue because you absent-mindedly listed them as guarantors.

- Chase targets with accountability - having money is all about the options it opens up for you. Once you’ve saved up enough, you’re free to chase any goal or career of your choosing. You’d be free to leave that toxic job, move from that apartment with the nagging landlord or take risks you simply couldn’t afford to before. Truth be told, some goals are simply impossible to chase without significant income - education, buying a home, starting a family.

- Set yourself up for retirement - the arrow of time always points forward. There’s no escaping it. Retirement might feel far off, but before you know it, you’re graying, and your children can no longer afford to take care of you. Better to be old and have the option of investing in the stock market than competing for work with younglings.

Saving money is about having control of your destiny. It’s insurance against uncertainty, a ticket to opportunity, and a way to live life on your terms. In a world of rising costs—housing up 5% annually, healthcare climbing even faster—those who save aren’t just surviving; they’re thriving.

What makes a good money-saving app?

Your biggest ally in the quest to save money and climb out of financial misery is technology. Lucky for you, we are in the golden age of software and automation. But with so many options on the app store, what separates a great money-saving app from a mediocre one?

Well, a good app doesn’t just promise to help you save - it delivers practical, user-friendly tools that align with your financial goals, lifestyle, and budget. Whether you’re aiming to build an emergency fund, invest for the future, or simply curb overspending, here’s what to look for to ensure an app is worth your time and (sometimes) your money.

Automation The hallmark of a standout money-saving app is its ability to automate the process. Why? Because willpower alone often falters when life gets busy. Automation removes the mental burden, making saving a seamless part of your routine—think of it as a financial assistant that never sleeps.

Goal-setting tools Saving feels pointless without a purpose. A good app lets you define and track specific goals, turning vague intentions into actionable plans. Clear goals keep you motivated, and seeing the numbers grow reinforces the habit.

Budgeting integration Saving more starts with spending less, and that’s where budgeting features shine. The best apps don’t just hoard your cash, they help you understand your financial flow.

Investment options Saving is step one; growing your money is step two. Over time, this can outpace traditional savings accounts, where the national average interest rate hovers below 0.5%—thanks to stock market returns averaging 7-10% annually ( adjusted for inflation). It’s a low-effort way to build wealth, ideal for beginners.

Low or no fees Fees can quietly erode your savings, so a good app keeps costs minimal. Look for fee-free apps, or those whose fees are low enough that they don’t eat into your savings.

Security and Regulation Your money’s safety and data privacy are non-negotiable. Entrusting your funds and personal information to an app requires confidence in its security measures and regulatory standing. Here’s what signifies a trustworthy app in Kenya:

- Technical Security: Look for apps employing robust, industry-standard security protocols. This includes bank-grade encryption (like 256-bit AES) to protect your data both in transit and at rest.Multi-factor authentication (MFA) adds a critical layer of security to prevent unauthorized access to your account.

- Regulatory Oversight and Fund Protection: This is crucial and varies depending on how the app handles your money:

- For Savings held as Deposits: If the app places your savings into accounts with partner banks or deposit-taking microfinance institutions, check if these partners are licensed by the Central Bank of Kenya (CBK). Deposits in such institutions are typically protected by the Kenya Deposit Insurance Corporation (KDIC) up to KES 500,000 per depositor, per institution, providing a safety net if the partner institution fails.

- For Investments (MMFs, Unit Trusts, etc.): If the app facilitates investments, the underlying fund manager or the platform itself (if offering investment advice or dealing in securities) should be licensed and regulated by the * *Capital Markets Authority (CMA)**. CMA regulation ensures adherence to market conduct rules and provides investor protection mechanisms, although it does not insure against market losses (investments can go down as well as up).

- Data Privacy: Verify the app’s commitment to data privacy. It should have a clear privacy policy compliant with Kenya’s Data Protection Act, outlining how your personal information is collected, used, stored, and protected. Be wary of apps with vague policies or those that indicate they might sell your data indiscriminately.

- Transparency: Reputable apps are transparent about their security measures, regulatory licenses (often displaying license numbers), and partner institutions. Check their website or “About” section for this information.

An app might have slick features, but if it compromises on security or operates outside the established regulatory frameworks (CBK for deposit-taking, CMA for capital markets activities), the risk likely outweighs the potential rewards. Always verify the app’s credentials and partners before committing significant funds.

User experience A clunky interface can derail your saving efforts. The best apps—like Simplifi or Mint—offer clean dashboards, intuitive navigation, and real-time updates, so you’re not wrestling with tech to check your progress. Gamification helps too: Qapital’s “Money Missions” turn saving into a challenge, while Fetch Rewards offers points for scanning receipts. If an app feels like a chore, you’ll ditch it—look for one that fits your tech comfort level and keeps you engaged.

Flexibility Financial needs shift—job changes, unexpected bills, new goals—so a good app adjusts with you. You should be able to pause savings during lean months, or create a budget that allows flexibility. e.g. overspend in one category (say, groceries) by pulling from another (like entertainment). Apps with rigid rules or no wiggle room can frustrate more than they help, especially if money’s tight.

Educational value The best apps don’t just manage money-they teach you how to handle it better. Pick an app that makes you more familiar with budgeting, and insights to spot trends.

No single app fits everyone—it’s about matching features to your needs. A good money-saving app isn’t a miracle cure—it’s a tool that amplifies your effort, turning spare change and good intentions into real financial progress.

The 5 Best Apps for Saving Money in Kenya

Here are five leading apps designed to help Kenyans manage, save, and grow their money more effectively:

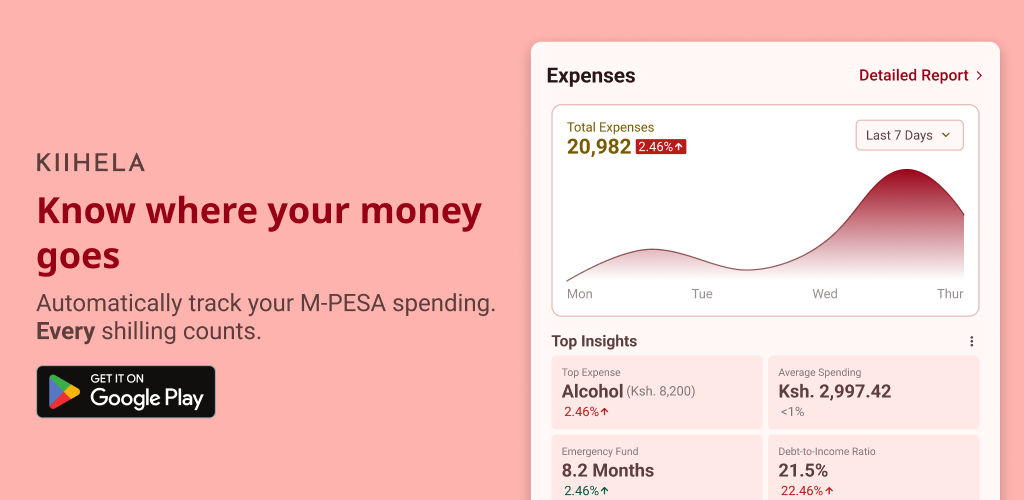

1. Kiihela

Kiihela is a smart financial assistant. Its core strength lies in helping you understand your spending habits by automatically tracking personal & business income and expenses.

- Key Features:

- M-Pesa Integration: Securely connects to your M-Pesa account to automatically fetch and categorize transactions, providing a real-time view of your spending without manual entry.

- Expense & Income Tracking: Automatically categorizes transactions, allowing you to see exactly where your money goes (e.g., transport, food, bills).

- Budgeting Tools: Allows users to create custom budgets for different categories (e.g., groceries, entertainment) and track spending against these limits.

- Goal Setting: You can set financial goals (e.g., save for a phone, emergency fund), but Kiihela primarily tracks your progress based on your overall financial health rather than holding dedicated funds.

- Interest Rates/Returns: None. Kiihela does not hold your money or offer interest. Its value comes from providing insights to help you save more effectively elsewhere.

- Fees: Operates on a freemium model. Core tracking features might be free, with potential premium features requiring a subscription.

- User Experience (UX): Generally praised for its clean interface, intuitive navigation, and use of charts and graphs to visualize financial data, making complex information accessible.

- Security & Regulation: Uses encryption to protect user data. Crucially, Kiihela is NOT a deposit-taking institution and does not hold user funds, hence it is not regulated by the CBK or CMA as a financial institution or investment platform. Its compliance focus is on data protection (Data Protection Act).

- Unique Selling Point (USP): Deep and seamless M-Pesa integration for automatic transaction tracking is its standout feature.

- Target User: Individuals who want a clear, automated picture of their spending habits, especially heavy M-Pesa users, and need help identifying areas to cut back.

- Pros:

- Excellent automated expense tracking via M-Pesa.

- Strong budgeting tools.

- Insightful visualisations.

- Helps build financial awareness.

- Cons:

- Does not actually hold or grow your savings/investments.

- Effectiveness relies on the user acting on the insights provided.

2. Cashlet

- Primary Focus: Investment Platform & Fund Marketplace.

- Overview: Cashlet provides a streamlined mobile platform giving users access to a diverse range of savings and investment products from multiple established fund managers in Kenya. It acts as a convenient gateway to easily compare and invest in different types of funds.

- Key Features:

- Wide Fund Selection: Offers access to 8+ different savings and investment products, including Money Market Funds (MMFs), Fixed Income Funds, USD Funds, and Shariah-compliant Funds.

- Multiple Partner Fund Managers: Features products from reputable, CMA-regulated fund managers such as ICEA Lion Asset Management, Etica Capital, Nabo Capital, and Orient Asset Managers, with more potentially added over time.

- Choice & Comparison: Users can compare performance and features of various funds within the app before investing.

- Low Minimum Investments: Designed for accessibility, likely allowing users to start with small amounts (verify specific minimums per fund).

- Goal Setting & Tracking: Enables users to create financial goals and monitor investment growth in real-time.

- Liquidity Options: Provides options for “instant access” withdrawals (subject to typical MMF processing times) and also an option to lock funds for disciplined saving.

- Smart Tools: Includes features described as “smart money management tools” to aid financial tracking and decision-making.

- Interest Rates/Returns:

- Returns are generated from the underlying assets (Treasury bills, bonds, corporate debt) managed by the partner fund managers.

- Interest is calculated daily and credited to the user’s Cashlet account daily around 10 am, providing frequent compounding and visibility of earnings.

- Advertised potential returns can be attractive (marketing mentions up to 16% p.a.). However, it is **critical

** to understand:

- These rates are variable, not guaranteed, and depend heavily on the specific fund chosen and prevailing market conditions.

- The highest advertised rate usually reflects the top-performing fund at a specific point in time, not an average or guaranteed return across all funds.

- Example Point-in-Time Rates (verify current rates): Etica MMF (~15.7% p.a.), Kasha MMF (~12.62% p.a.), Etica Fixed Income Fund (~14.34% p.a.), ICEA Lion MMF (~12.47% p.a.). These illustrate the variance and potential but will change.

- Fees:

- Fund Manager Fees: The primary cost is the annual management fee charged by the respective fund manager (e.g., ICEA Lion, Etica), typically ranging from 1% to 2.5% p.a., deducted from the fund’s overall returns. This is standard for Unit Trusts.

- Cashlet Platform Fees: Verify if Cashlet charges any additional platform, transaction, or withdrawal fees on top of the fund manager fees. The provided text focuses on fund manager fees.

- User Experience (UX): Designed to be simple and user-friendly, making it easy to navigate, compare different investment options, and track performance.

- Security & Regulation:

- Platform Security: Employs bank-level encryption to protect user data and transactions. States commitment to data privacy, not storing or using data without consent.

- Regulatory Oversight:

- Cashlet states it is regulated by the Capital Markets Authority (CMA). Users should verify this status independently on the CMA website.

- Crucially, all partner fund managers (ICEA Lion, Etica, Nabo, Orient, etc.) are also independently licensed and regulated by the CMA.

- Funds are invested in market instruments and are not insured by KDIC.

- Unique Selling Point (USP): Offers a wide marketplace of diverse funds (MMF, Fixed Income, USD, Shariah) from multiple regulated managers within one app, coupled with the benefit of daily interest crediting.

- Target User: Beginners and experienced investors looking for a convenient way to access and compare a variety of investment funds (including MMFs, Fixed Income, USD, Shariah) with low minimums and daily interest visibility.

- Pros:

- Excellent choice of fund types and managers in one place.

- Daily interest calculation and crediting enhances visibility and compounding.

- Potential for competitive returns (variable).

- Both platform and partners are CMA regulated.

- Features like fund locking and instant access cater to different needs.

- Strong security protocols mentioned.

- Cons:

- Advertised high rates need context – actual returns are variable and not guaranteed.

- Cashlet charges additional platform fees beyond fund manager fees.

- Reliant on partner fund manager performance.

- Carries inherent market risk (no KDIC insurance).

3. Chumz

- Primary Focus: Goal-Based Micro-Savings & Investment.

- Overview: Chumz aims to make saving easy and accessible, particularly for young people or first-time savers. It cleverly integrates goal-setting with micro-investment, channeling saved funds into an underlying investment product ( typically a Money Market Fund via a regulated partner) to help your money grow.

- Key Features:

- Goal Creation: Users set specific, tangible savings goals (e.g., “New Phone Fund,” “Rent Deposit”), making saving purposeful.

- Flexible Saving Methods: Offers various ways to save, including automated recurring deposits (daily, weekly, monthly) and manual top-ups via M-Pesa.

- Underlying Investment: Savings are channeled into a Money Market Fund managed by a partner firm (Nabo Capital is a known partner). This allows savings to earn potential returns based on MMF performance.

- Social Saving (Potential Feature): Check for features allowing users to save towards shared goals with friends or family, adding a community aspect.

- Interest Rates/Returns: Returns are derived from the performance of the partner MMF (e.g., Nabo Capital MMF). Expect variable returns historically in the 8-12% p.a. range (gross), but this is not guaranteed and fluctuates with market conditions. Interest is typically calculated daily and compounded monthly. The net return will be after the fund manager’s standard annual management fee is deducted.

- Fees: Chumz has a transparent fee structure:

- Deposits: No fees charged by Chumz. Users only incur the standard M-Pesa Paybill charges levied by the mobile service provider (Safaricom).

- Withdrawals: Chumz charges a small, flat withdrawal fee to cover operational costs:

- KES 20 for withdrawing amounts less than KES 1,000.

- KES 30 for withdrawing amounts from KES 1,000 up to KES 150,000 (standard M-Pesa transaction limits apply).

- Underlying Fund Management Fee: This is separate from Chumz’s fees. The partner fund manager (e.g., Nabo Capital) charges an annual management fee (typically 1-2.5% p.a.) which is deducted directly from the fund’s overall returns before they are distributed to investors. This is standard practice for all Unit Trusts.

- User Experience (UX): Generally focused on simplicity and motivation, possibly incorporating gamification elements to encourage consistent saving towards goals. Designed to be intuitive for first-time savers.

- Security & Regulation: Uses encryption for data protection. The partner fund manager (e.g., Nabo Capital) is licensed and regulated by the Capital Markets Authority (CMA). User funds are invested through this regulated entity, providing oversight. Funds are invested in the market and are not covered by KDIC.

- Unique Selling Point (USP): Strong emphasis on goal-based saving, very low barrier to entry, transparent (and relatively low) platform fees, making saving feel tangible and achievable.

- Target User: Young adults, students, first-time savers/investors, individuals motivated by specific savings goals and who appreciate a simple fee structure.

- Pros:

- Excellent for goal-oriented saving.

- Very accessible with low minimums.

- Potential for MMF returns via a regulated partner.

- Transparent and modest withdrawal fees; no deposit fees from Chumz.

- Cons:

- Net returns are impacted by the standard underlying MMF management fee.

- Returns are variable and not guaranteed (market risk).

- Investment choice is typically limited to the partner MMF.

- Small withdrawal fees apply.

4. Zimele

- Primary Focus: Direct Investment in Zimele Unit Trusts.

- Overview: Zimele Asset Management is a long-established fund manager (since 1998), licensed by the Capital Markets Authority (CMA). Their platform (accessible via Web and a dedicated Android App) provides Kenyans direct access to invest in their own range of Unit Trust funds, offering options for both saving and long-term investment.

- Key Features:

- Fund Options: Offers two main funds:

- Zimele Savings Plan (Money Market Fund): Invests in low-risk, interest-earning assets like Treasury bills/bonds and fixed income. Designed for stability and capital preservation.

- Zimele Investment Plan (Balanced Fund): Invests in a mix of shares listed on the Nairobi Securities Exchange (NSE) and interest-earning assets. Aims for long-term capital growth and carries higher risk.

- Low Minimum Investment: Start investing in either fund with just KES 100.

- Accessibility: Manage investments via the Zimele website or the Android mobile app. Deposits can be made easily via M-Pesa Paybill (501101), cheque, or standing order.

- Account Types: Supports individual, joint, chama, group, and corporate accounts.

- Transparency: Provides online statements and performance tracking via web/app. Fund performance is also often published in national newspapers.

- Fund Options: Offers two main funds:

- Interest Rates/Returns:

- Money Market Fund: Offers variable interest based on the performance of underlying fixed-income assets. Zimele describes it as “competitive.” Crucially, interest is compounded annually, which is less frequent than many other MMFs that compound monthly or daily. Returns are not guaranteed.

- Balanced Fund: Returns are primarily through potential capital gains on the units, driven by stock market performance and interest income. Designed for long-term growth (2+ years recommended), performance can be volatile, and returns are not guaranteed.

- Fees:

- Zimele Savings Plan (MMF): Subject to an annual management fee of 2% of the funds under management. The brochure states “no hidden charges” for this fund beyond the management fee (standard M-Pesa deposit charges apply).

- Zimele Investment Plan (Balanced Fund): Has a more complex fee structure:

- Initial Administration Fee: 3% charged on every new investment/deposit made into the fund.

- Annual Management Fee: 2.5% of the funds under management.

- User Experience (UX): Provides core functionality through web and app (Android only mentioned). Focuses on direct investment management and statement access. May feel more traditional compared to newer fintech apps but offers multiple access points.

- Security & Regulation:

- Regulated: Zimele Asset Management Ltd is licensed and regulated as a fund manager by the CMA.

- Strong Structure: Employs a robust structure mandated for Unit Trusts:

- Custodian: Standard Chartered Securities Services holds all client assets (cash and investments) safely, separate from Zimele’s own accounts.

- Trustee: Kenya Commercial Bank (KCB) Trustee Services ensures Zimele acts in the best interest of investors according to regulations.

- This separation significantly enhances security and reduces operational risk. Investments themselves carry market risk and are not covered by KDIC.

- Unique Selling Point (USP): Direct investment with a long-standing, reputable fund manager. Clear separation of roles (Manager, Custodian, Trustee) enhancing fund security. Offers both a stable MMF and a growth-oriented Balanced Fund.

- Target User: Individuals seeking direct access to funds managed by an established provider, those comfortable choosing between a conservative MMF and a higher-risk Balanced Fund, investors who prioritize the security structure ( Custodian/Trustee), and those for whom annual MMF compounding is acceptable.

- Pros:

- Managed by a long-established, CMA-regulated company.

- Excellent security structure with separate Custodian and Trustee.

- Offers choice between MMF (stability) and Balanced Fund (growth).

- Low minimum deposit (KES 100).

- Multiple access channels (Web, App).

- Cons:

- Money Market Fund interest is compounded annually (less frequent than many competitors).

- The Balanced Fund has a significant 3% initial fee on every deposit, plus a 2.5% annual management fee, making it relatively expensive.

- Mobile app currently mentioned only for Android.

- Investment returns are variable and not guaranteed.

5. Flexpay

- Primary Focus: Save-to-Buy / Goal-Based Savings Platform.

- Overview: Flexpay often partners with merchants to offer a “save-to-buy” model. Users save towards a specific product (e.g., phone, furniture, appliance) offered by a partner merchant, often locking in the price and potentially receiving discounts upon completion. It’s a structured way to save for specific purchases.

- Key Features:

- Goal-Oriented Saving: Users select a specific product they want to buy from a partner merchant.

- Payment Plans: Save towards the item over a set period through regular contributions (e.g., daily, weekly, monthly).

- Price Lock / Discounts: Often locks the price of the item when you start saving, protecting against inflation. May offer exclusive discounts upon completing the savings goal.

- Merchant Partnerships: Works directly with various retailers and businesses.

- Potential Interest/Rewards: Some models might offer small interest or rewards on savings held, though the primary benefit is usually the purchase facilitation and discount (verify specific terms).

- Interest Rates/Returns: Typically low or none. The main financial benefit isn’t high interest, but rather the discipline encouraged, price-locking, potential discounts, and avoiding debt for purchases.

- Fees: Verify Flexpay’s model carefully. Check for service fees, cancellation policies, and potential penalties.

- User Experience (UX): Usually designed to be straightforward – select item, set plan, make payments.

- Security & Regulation: Funds handling needs clarification. Verify how funds are held (e.g., in trust). Check Flexpay’s regulatory status (CBK or CMA oversight may apply depending on the exact model and partnerships). Data encryption is standard.

- Unique Selling Point (USP): The “Save-to-Buy” model, enabling disciplined saving for specific products with potential price locks and discounts, acting as an alternative to instant purchase credit.

- Target User: Individuals who want to buy specific items without using credit, need structure and discipline to save for purchases, and appreciate potential discounts/price locks.

- Pros:

- Encourages saving discipline for specific goals.

- Helps avoid debt.

- Potential price locks and discounts.

- Clear target for savings.

- Cons:

- Funds may earn little to no interest compared to MMFs.

- Limited to products from partner merchants.

- Potential fees or restrictive terms if you cancel.

- Regulatory status and fund protection mechanisms require verification.

Disclaimer: Information provided here, especially regarding interest rates, fees, and specific partners, is based on general knowledge and typical structures. These details can change. Always verify the latest information directly from the app providers’ official websites, terms of service, and relevant regulatory bodies (CMA, CBK) before making any financial decisions. This article is for informational purposes only and does not constitute financial advice. Remember that investments carry risk, and past performance is not indicative of future results.